Employee Benefit Guidance & Compliance Solutions

Our Partners »

EXPLORE PF Compass

Our Purpose

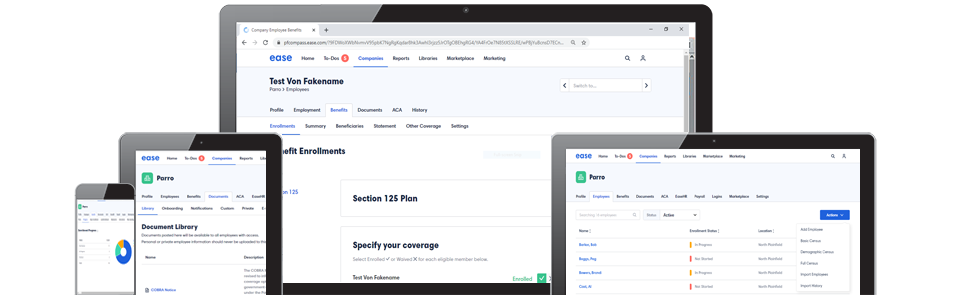

If your company is between 2 and 500 lives, PF Compass has you covered. Employers today are blindsided by double-digit renewal increases because their current representation hasn’t provided them with a blueprint to manage their employee benefit options.

Our Services

Many of today’s broker/consultants are only seen at renewal or when a claims issue arises. Unfortunately, many businesses are unaware that there is so much more their broker/consultant should be doing. At PF Compass we go well beyond what has become common broker responsibilities.

Our Clients

We work with all types of businesses, large and small, across a wide range of industries. Over the years we have created a reputation of providing quality group benefits and unmatched service for all our clients.

LATEST FROM PF COMPASS

Decoding Group Healthcare Costs: What Are You Paying For?

Navigating the labyrinth of group healthcare costs can be as daunting as it is crucial. For businesses, providing healthcare benefits is a significant investment, but what exactly are you paying for? Let’s demystify the components of group healthcare costs, offering a clearer perspective for business owners and HR professionals alike. The Anatomy of Group Healthcare Costs Understanding the breakdown of healthcare costs can empower you to make informed decisions and potentially identify areas where savings can be achieved. Here’s what makes up the bulk of your group healthcare plan expenses: 1. Premiums: The Core Expense Premiums are the most apparent cost associated with healthcare plans. They are payments made to insurance companies to cover the cost of health benefits for employees. Premiums can vary widely depending on the plan’s coverage level, the insurer, and the demographic makeup of your employee group. 2. Deductibles: The Initial Outlay Deductibles are the...

read moreComplimentary Plan Review