News

News

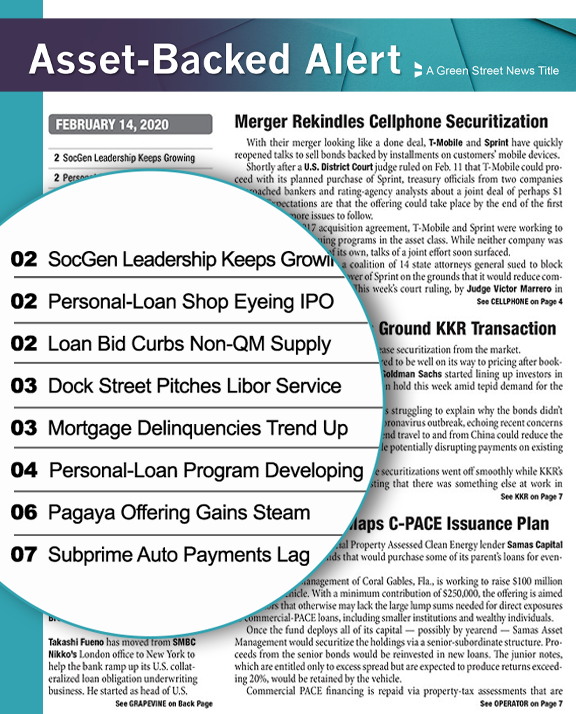

Commercial Mortgage Alert

Exclusive reporting on behind-the-scenes activities in real estate finance and securitization

Selections From Recent Issues

Publication Overview

Identify new financing opportunities and stay ahead of your competition in CRE finance with Commercial Mortgage Alert. This weekly publication conveys the earliest look at key dealings in today's commercial MBS and traditional real estate debt markets.

- 25+ Years of Reporting

- 45K+ Users

Obtain Breaking News & Exclusive Stories

- Understand discreet plans, new alliances and strategic initiatives of borrowers and lenders

- Receive forward-looking news and data on supply-demand shifts, valuation trends and competitive intel

Identify Imminent Risks & Opportunities

- Utilize the exclusive financing plans of big property owners

- Obtain deal term developments to gain insight on future market direction and deal structure requirements

Leverage Competitive Intel to Stay Ahead

- Discover potential high-value partners and new risk-takers among market participants

- Use exclusive league-tables and listings to track the progress and missteps of lending competitors

Garner a Recruitment Edge

- Learn of real estate finance and securitization career openings, corporate setbacks and personnel cuts in the much-coveted Grapevine column

*While Green Street offers some services as an investment advisor, the US Research, Data, and Analytics products along with its global News publications are not provided as an investment advisor nor in the capacity of a fiduciary.

Start Reading Today

Easily start your Commercial Mortgage Alert subscription by clicking the Subscribe Now button below.

Paid Circulation by Business Type

Editorial Calendar

CMA - Editorial Feature

CMA – Conference Distribution

Rankings Table

Figures represent total sizes of deals, which are shown by risk-retention structure. Excludes rake bonds.

About Green Street's News Products

Access three highly-regarded weekly publications and five related databases that deliver exclusive news and data on the commercial real estate and finance markets and participants. These insights are not available elsewhere and are religiously relied on by senior executives at the largest and most active firms in the industry.*