Questions Worth Asking

That number.

I hadn’t seen that number pop up on my phone in years. 12 years to be exact.

I’ve thought a lot about the conversation I had the last time that number popped up on my phone. I can still remember where I was standing, the time of day and the way the air felt on my skin as I sat on the stoop in front of my house as I answered that call.

It was the fall of 2005 and we were in the final stretches of closing our first fund. Earlier that year, we’d talked to Freada Klein and Mitch Kapor about investing in the fund. Seed investing was still a new concept, but they both have a nose for what’s next and they seemed intrigued. We’d connected on a number of levels and it was looking good that they would commit. Prior to making the commitment, they’d asked to talk to me personally, one on one. It seemed this conversation was the only thing standing between our fund and their investment.

Then that number popped up on my phone.

Both Freada and Mitch were on the line. They said they had one question they wanted to ask before making a commitment.

In prior professional lives, Freada had worked around a number of Mormon men (I’m an active Mormon). She noted that Mormons traditionally encouraged women to work within the home as mothers and caretakers to the family. Her past experiences with Mormon men suggested that they explicitly, or implicitly brought this artifact of Mormon culture with them into the workplace. The result, she observed, was that these men were reluctant to hire and promote women.

Thus this call.

They wanted to ask me, explicitly, if my Mormon faith would keep me from funding female founders. The tone of the question was not confrontational, or even judgemental, it was earnest. I didn’t get offended or get defensive, I tried to process it with that same level of earnestness shown me.

To be honest, the thought had never crossed my mind. But as I sat on that stoop, the weight of that question began to settle in.

What if there were scenarios where my cultural norms or ideals were in contrast to those across the table from me? Would I? Could I? still fund them with the same level of conviction and support that I could others who worked, lived, looked, thought or worshiped like me?

I don’t remember what I said on the call. I’m certain it was nothing profound. But it was sufficient enough to receive a commitment from Freada and Mitch to become investors in our first fund.

In hindsight, the impact of any dollar amount they committed to the fund pales in comparison to the impact that question has had on me ever since.

12 years later I still think about that call near weekly.

There are questions being asked in and around tech and venture capital these days. Some of these are tough questions. Some are uncomfortable questions. But they’re questions worth feeling the gravity of. Worth wrestling with. And worth paying more than lip service to.

I am grateful for the people, like Freada and Mitch, willing to ask them.

OATV and Indie.vc

Around this time last year, Christopher Mims at the Wall Street Journal did a profile on the experiment we were running with Indie.vc. Buried in the piece was a mention of a new fund we’d closed to continue iterating on the experiment.

That’s the only mention of the new fund.

In the proceeding months since his piece, it has become clear to me that there’s still some confusion around the relationship between OATV and Indie.vc. Tho I’ve shared the relationship between the two in private emails and conversations, I think it’s worthwhile to unpack it a bit more publicly so we can remove any confusion about the current state of both.

OATV (O'Reilly AlphaTech Ventures) was founded in 2005 by myself, Mark Jacobsen and Tim O'Reilly. We were one of a handful of “institutional” super angel/micro VC/seed funds, which is to say that we raised a sizable ($50M) pool of capital from outside investors.

The category was young and new and exciting and, to many, counter-intuitive. It was not an easy time to raise a seed fund and we were not an obvious seed fund to back. We had a limited track record, very little experience as professional investors, shoot, we didn’t even live in the same state! After 2yrs of beating the street, we closed OATV Fund I in December of 2006.

From the get go, we structured out single fund to execute two distinct investment strategies.

The first was to lead or co-lead seed rounds. These rounds were typically first money in, the rounds were generally sub $2M total in size, and we would take an active role in these companies as board members. Believe it or not, this was a wildly new idea at the time!

The second strategy was to use a portion of each fund as a pool of capital to make Tim’s angel investments. These were typically angel size checks of a couple hundred thousand dollars written into rounds being led by larger funds into companies operating in thematic areas of interest to us run by founders we had relationships with. These hovered around less than 5% of the dollars in any given OATV fund.

Fast forward to this time last year.

In his article, Mims notes our new fund would have a focus on Indie.vc. It’s worth clarifying here that the new fund is, in fact, named OATV Fund IV.

Original, I know, but meaningful.

When it comes to OATV and Indie.vc they are the same thing. OATV is the Fund, Indie.vc is the strategy.

In Fund IV, we are still actively making Tim’s angel investments and allocating a larger percentage of committed capital to them.

However, we are not leading or co-leading traditional seed rounds as we’ve done it that past. That strategy has been replaced with our Indie.vc strategy.

This is a notable change. It is one that we did not take lightly. Nor is it one that was universally well received by our investors or our peers in the seed and VC community.

But…

When we ran our initial Indie.vc experiment we felt the same spidey sense that we were on to something as we did when we were connecting the dots on the emergent seed funding market back in 2005. We were misunderstood by those same constituents then and we are comfortable being misunderstood by them now.

In that same 2 year span another troubling development has begun unfolding. In recent months, weeks and days it has become clearer and clearer that there are larger scale systemic issues embedded in the current VC models for what and who gets funded and how those companies are nurtured and scaled.

We firmly believe ambitious founders deserve an alternative. So we bet our firm on it.

It hasn’t been easy but the response from founders and the early results we are seeing within our growing portfolio of companies reinforces daily our decision.

So…

In case there was any doubt, we are open for business! and actively investing Fund IV in companies that resonate with our Indie.vc model as well as making angel investments alongside our friends at more traditional early stage firms.

If you’re interested in Indie.vc funding, you can tell us about your business here.

If you want to see the areas we’re tracking for our angel investments, you can get a sense for those here.

Friend or Financier?

The biggest mistakes I make as a VC come when the emotions of friendship cloud the realities of being a financier.

That’s an easy line to blur when your business is based on personal relationships with founders and instinctual investments. At the earliest stages, when there’s little, if any, meaningful data on which to anchor a decision, an affirmative answer to the question of “is this someone I believe in” is often all an investment decision hangs on. Working closely with, and believing in, founders often leads to deep and meaningful friendships.

I often envy the Warren Buffet types who pour over cold and sterile annual reports, company financials and stock charts looking for anomalies to explore and untapped value to unlock. There’s a structure and precision to their craft of picking. Yes, over time, they occasionally build friendships with managers they back, but those relationships begin on a bedrock of something much deeper than blind belief.

There’s a stark contrast between those two worlds that becomes much more blurry when combined in our little corner of the financial market.

Friendships are messy and emotional. We tolerate imperfections in friends we wouldn’t in others. We look past flaws in friends we couldn’t unsee in acquaintances. We, occasionally ignore those gnawing feelings of correction and confrontation for the sake of the longer term relationship.

Letting emotions and personal connections drown out the sounds of actions speaking louder than words can be a very real hazard for someone trying to do this job well. Continuing to believe, when the data, actions and market clearly says otherwise, is what friends do. Not financiers.

That’s a very real rub in this business.

One that I’ve felt acutely.

One that I’ve failed to feel acutely enough. Or, at least, felt acutely enough to step back, see it for what it is, and tackle investment decisions clearly seeing that blurry line as the backdrop.

The best investors in public and private markets understand which of these to be when. Those of us striving to be the best would do well to do the same.

What Are You For?

Today feels like the golden age of being Anti something.

If my Twitter feed is any indication, there is literally no end to what people are being Anti of

Anti Trump.

Anti Hillary

Anti Fox News.

Anti CNN.

Anti Bay Area.

Anti New York

Anti Wal Mart.

Anti Juicero.

Literally no end.

Indie.vc has even been described as Anti-VC.

We aren’t anti-VC, we’re for profitability and all the freedom that comes with it. Freedom to choose how, when and if to scale. Freedom to raise, or not, from a hugely leveraged position.

We think founders who are for that too are great people to be in business with. And we think the companies they’re building on that solid foundation can make for great returns.

We’re for all of that.

Being anti something pushes people and ideas away.

Being for something pulls them in.

Try it.

The next time you want to go full rage against the machine, flip your anti angst into a foray into for and see what a difference it makes.

The Time Thief

Amy Krouse Rosenthal died yesterday.

I don’t know her, but I cried when I read the dating profile she wrote for her soon to be widowed husband.

Like, big ugly cried.

I can count the number of times I’ve cried as an adult on one hand. Well maybe I’d need to borrow a few fingers, but the point is I rarely ever cry.

Maybe its because my wife is out of town and I miss the mornings with her after the kids have gone to school and the nights where we don’t even have to be talking but just being near each other is enough to put us both at ease.

Maybe it was because my son had posted a picture with his arm around his little girlfriend wishing her a happy birthday. And he still looked like a little boy. Like my little boy. And I know that won’t last much longer because within months his voice will start to change. And he will change. And he won’t be that sweet little boy with his arm awkwardly draped around an awkwardly adorable little girl with braces. He will still be my son, but that little boy will be a memory as I welcome the man he’ll be.

I don’t know if any of those reasons are the reasons I was ugly crying reading news that a woman I’d never met have died.

Women I’ve never met die everyday and I don’t cry.

Let alone ugly cry.

But something about this woman, and this woman’s words as she met her end stirred something in me. They say that hearts are the ears of the soul. And mine needed to hear what Ms. Rosenthal had to say.

“I want more time with Jason. I want more time with my children. I want more time sipping martinis at the Green Mill Jazz Club on Thursday nights. “More” was my first spoken word (true). And now it may very well be my last”

Notably she wasn’t asking for more time with her phone. Or with the brands that she’d built a relationship with.

They say that there is a war being waged for our time and attention. That companies of all kinds are competing for little spaces in our days and in our brains and in our shopping baskets. As with every war, there are winners and there are losers. If the brands, and social networks and media outlets win, who loses?

Maybe the reason for my ugly cry was that I know who loses.

And who is losing.

Last night, I found my two older kids on the couch watching the Bachelor. I mean, ugh! But, instead of retreating to my office for more working, or surfing or scrolling I sat. Instantly I was flanked on each side with two cuddly kiddos. A moment of more.

In a war that feels like a constantly losing battle, this felt like a small win.

Thank you, Ms. Rosenthal. I hope you were able to savor what little more you were able to while you could.

Living Above the Store

In another life I will come back as a chef with a small restaurant in a little village with less than 10 seats inside and a quaint patio outside. Word of my talents will spread far and wide and people will come from the furthest corners of the earth to sit and sample and soak in the special little space we’ll create.

Until then, I’ll watch Chef’s Table on Netflix.

There are so many wonderful lessons for founders to take from the unique perspectives on food and business and creatively shared by the chefs the show profiles.

For even the most talented chefs, the business of starting and running a restaurant makes launching your website in your underwear look as simple as, well, launching a website in your underwear. Their stories of sacrifice, perseverance, overcoming obscurity and rising to fame are so well crafted in the course of 45 minutes. Someone could write a dozen posts just teasing our patterns for founders.

This is not one of those posts.

But, there has been one theme throughout the previous seasons that has stuck with me. And has given me a new way to frame the tired and tortured debate on work/life balance.

No one I know likes that term. No one I know with a family or a business or a personal life feels they’ve nailed that perfect “balance”.

That’s likely because balance among all those variables is an impossible goal.

But many of the chefs profiled have something about it figured out.

Not in the sense that they have struck the perfect balance of their family and their business and their obsession with food but that they marry them as a core part of the life they’re building.

In many cases, in the early days of their restaurants (and often later) they live above their stores.

Like, literally above it.

The restaurant is on the street level and they have an apartment above.

As the editors of the show take us back in the history of these famed restaurateurs you’ll often see photos of their partners, or spouses or children hauling in supplies, chopping produce or having a meal with them in the back office prior to service. You’ll see their living spaces, and the steps and stairs the constitute their commute. There isn’t some arbitrary separation between the work they’re doing and the people dearest to them. Their lives and efforts are intertwined. All invested in a shared vision, with proximity to see it take shape day in and day out.

As someone who’s a bit (read- a lot!) obsessive about the work I do, that metaphor, of living above the store, has given me a new visual framework for thinking how to incorporate my work and my family. Not with the goal of striking a perfect balance, but with blurring those distinct lines altogether.

And if I don’t figure it out in this life, I’ve always got that little restaurant in the next one to really nail it.

My First Lyft Ride

Over the years I’ve used Uber 600+ times and spent 10s of thousands of dollars with them. I am neither an Uber apologist nor critic, but I did something today I’ve never done.

I used Lyft.

I have actively disliked Lyft since the get go. The fist bumps, the pink mustaches, the overly friendly drivers. Not my style.

The choice today was not made lightly. But it was revealing.

I remember back when Google went public. There were countless and breathless debates about how there were no switching costs for anyone to move from using Google to using, say, Yahoo. No one was locked in. They could just as easily point to another search engine to find what they needed. Search was search, a commodity.

Tho, at a high level that may be true (search being search) to the average user of Google at the time, Google was a revelation. The user experience and quality of search results were just so markedly better. Sure, theoretically, there were no switching costs, but you couldn’t unsee that early experience with Google. You were never going back to a portal again.

I did not have that experience with Lyft.

In fact, I had the opposite experience.

As I sat there in the back seat rolling to my destination (yes, I am a backseat guy) it began to settle in that this Lyft ride was nearly identical to every UberX ride I’d ever taken. From the app onboarding, to route selection, to driver arrival- identical. The Lyft car and driver looked and acted like every Uber car and driver I’d ever experienced. And that would make sense. Over the years as an UberX rider, it has become pretty clear that most drivers drive for both.

So, same cars, same drivers, same onboarding, same credit card, same route to my house. The cost of switching to Lyft was the time it took me to enter a credit card into the app. It was not as simple as typing in the URL for another search engine, but pretty darn close.

One notable difference- Lyft was $3 cheaper, but the app prompted me to tip the driver later. So, cost was in band enough to not feel like a real differentiator.

So.

Zero switching costs. Commodified experience. Shared labor pool. No network effects. No lockin.

In the past I’ve had more of an aversion to the Lyft brand than I’ve had a loyalty to the Uber brand.

After today’s ride I feel even less of a connection to either of their brands. Unlike my first experience with Google where I could not unseen the difference, the Lyft and Uber experiences are utterly indistinguishable to me.

And that should be troubling to both of them.

If You Don’t Know How Much You Need the Default is Always “More”

“What’s your end game?”, I asked

This particular founder had just raised a mid eight figure round of funding. And, after hearing about struggles with their board, struggles with the new investors and watching their ownership drop from mid double digit percentages to high single digits I couldn’t help but wonder.

What’s your end game?

Seemingly surprised, the founder shot back that this round was a step towards the next nine figure round and another brick in a world domination strategy to upend a market longing to be disrupted.

But is that really what they wanted or is that what investors wanted to hear? Upon reflection, this founder acknowledged that they would likely be replaced or leave by the next round.

A disruptor disrupted.

We see this all the time with startups and fundraising.

How much do you want to raise? $2M.

How much do you really need to raise?

That’s a much harder question. It requires far more introspection than many are willing to give it. For most, they think it is about the dollar amount. But it’s never really about the dollar amount.

Why do you want to raise $2M?

Because that’s what investors and other founders tell you you have to ask for in order to get the right people around the table. Any more and you’re too greedy w/o enough proof points. Any less and you’re not ambitious enough.

So, we default to wanting more.

More money. More market share. More mindshare. More press. More users. More data. More employees. More of the dream.

Without a clear idea of what we need, the answer will always be more.

What we need to be satisfied, to make our mark may not be what others want to hear. May not be what investors want to fund. May not attract an army of employees.

Not everyone needs to upend an industry. Not everyone needs to raise nine figures of funding. Not everyone needs to own single digit percentages of their business.

But, if you don’t know what you DO need, the default will always be more.

One (round) and Done

Just as we’re running out of derivatives for “seed” and letters in the alphabet there’s a new funding trend emerging.

Call it Bootstrap+, Fundstrapping or Series 1 and done, there seems to be a move towards simplifying the various funding schemes and getting down to the business of building a real business.

In their funding announcement last week, the Text IQ team was careful to note their profitability. And not just a token “ramen” level of profitability:

The startup is profitable, with January revenue of 10x its burn rate and sales expected to be in the millions for the quarter.

Interestingly, and relevant to this trend, they’re viewing this as a strategic round of funding and possibly the only round they’ll raise:

Text IQ is profitable. And for its first outside funding, it’s taking only about $3 million from top investors and veteran legal counsels in a seed round its founders say could be the only money it ever needs.

Funny thing is, they didn’t appear to “need” the money.

Unlike many startups who will go out of business if they aren’t able to raise another round, Text IQ seems to have a more specific need with this raise; namely, to get certain skills, expertise and networks around the table and invested at different level as they build their business

Through our work with Indie.vc we are seeing this trend at an increasing rate.

It’s an appealing path.

Founders can trade the fundraising treadmill for the freedom, control and ownership that comes with managing your cap table closely. Reliance on revenue keeps them close to their customers. And it rewards that early, and often painful, focus on revenue and sustainability with less dilution and more optionality.

I’d wager that we’ll see an increasing number of the best and brightest founders choosing this route in the near future.

In fact, we’re betting our business on it.

Helluva Lifestyle Business You Got There

Unicorns and venture capital go hand in horn. Or so the story goes.

Have a billion dollar idea, raise a little bit of money, show a little traction, raise a lot more money.

Rinse and repeat.

You can’t compete with out it! They say.

You can’t scale without it! They say.

Weaponized balance sheets have become the competitive strategy of this anabolic age.

Anything less makes for a less ambitious business owner running a “nice little lifestyle business”

But there’s an interesting trend brewing.

If you look at the last 6mo. of $1B +/- tech exits, you’ll notice something peculiar.

Of the 9 exits in that range there are 2 IPOs (The Trading Desk and Nutanix) and 7 M&A transactions.

4 of those M&A transactions are what you’d expect:

- AppDynamics acquired for $3.7B ($314M raised from from VCs)

- Jet.com acquired for $3.3B ($565M raised from VCs)

- Square Trade acquired for $1.4B ($248M raised from VCs)

- Merkle acquired for $1.5B ($124M raised from VCs)

Then there are 3 that look very different:

- AppLovin acquired for $1.4B ($4M raised from friends and family)

- Media.net acquired for $900M (no investment from VCs)

- Outfit7 acquired for $1B (no investment from VCs)

Over time, ambitious founders have been trained that billion dollar exits are reserved only for those who follow a very defined playbook for blitzscaling a business. Yet, 3 of the 9 tech exits in the billion dollar range in the last 6mo. were not VC backed.

The biggest disruptive threat to venture capital is not crowdfunding or Angel List or hedge funds.

No.

The biggest disruptive threat to venture capital is when the very best founders realize they need very little of it to scale.

Given the energy and focus we are putting behind Indie.vc, we anticipate that this trend will not only grow, but accelerate.

Lessons Learned From a Million Miles and 5 Kids

It was super early and I was still waking up and maybe I was a little grumpy but seriously why was this flight attendant being so nice to me? They had way too much energy and knew way too much about me to be so in my face at 5am.

“This is a big day for you today isn’t it Mr. Roberts?”

Um. Sure?

Silence fell over the cabin as the Captain saddled up to my arm rest. A firm handshake and a few awkward moments later a Delta Executive boarded the plane and revealed the morning’s surprise.

I was presented with a pen and a note and a voucher for a roller bag.

Congratulations Mr. Roberts!

You’ve just passed 1 Million miles on Delta.

Thank you for your business.

The ensuing flight ended up being far more reflective than I’d planned.

I started travelling near weekly about 11 years ago. My oldest child was 7 and I only had 3 of them back then. 11 years, and a million miles later, I have 5 kids, one of them in college, and some hard learned lessons about being a dad and raising a family while spending all of that time on the road.

I’m often asked by younger parents how to make it work. Short answer: it’s only as awful as you are.

This may be terribly disappointing but there is no magic schedule that makes traveling easier on everyone. Two weeks gone, and a week of working from home can work. One week on the road, one week off the road can work. I tend to stick to a maximum of 3 nights gone at a stretch (usually I can keep it to a night or two) and limiting travel to a max of two weeks a month.

Tho there isn’t a magic schedule, there are things you can do to make a heavy travel schedule more manageable for everyone.

Be Consistent. If you’re going to travel heavily, try your best to make it consistent. First week of every month. Every Tue/Weds. Whatever you settle on, try and keep it consistent. That will help with communication and expectation setting. It will also let you plan trips far enough in advance that you’re not scrambling all the time, which is a recipe for a houseful of tears.

I’m in the fortunate position of having some control over my travel. One of the keys to mapping out manageable travel plan is to get the kids calendar from the school before mapping out any of my other travel for the year. I get every vacation day, school program and parent teacher conference in the calendar ad built the rest of my schedule around that. I’ve missed plenty of their school events and games and recitals over the years, but I’m at least able to communicate that to my family far in advance which seems to help with the short term disappointment of getting a trip sprung on them at the last minute.

Be Communicative. If you can’t communicate to your partner clearly and early when and where you’re going, it’s going to be rough. Communication is absolutely the only thing that will save your family with a heavy travel schedule. Want your partner to hate you? Consistently spring trips on them last minute. Want your kids to hate you? Tell them the night before a school program that you’re going to miss it. I have been that guy more times than I care to admit. But, I’m also about to celebrate my 21st wedding anniversary. Some lessons I had to learn the hard way and communication is one of them.

One tool we use to remove the mystery from travel is a shared TripIt account. A single source of truth for pending travel has removed a ton of the friction from those previously awkward “you’re going again!?!” conversations when travel is sprung last minute.

Be HERE. Your body is not missed while you are on the road, you are. So, whether you decide to take a couple days off after a week of travel or work from home the day after a long trip only to spend that time staring at your phone or answering kids questions with grunts you might as well hightail it back to the airport. Your physical presence provides no relief to a partner who’s been holding things together while you’re gone. In most cases, they were doing just fine without you. So, getting home from a business trip doesn’t mean vacation time, it means double time. The bank account has been fully depleted while you’re on the road so it’s time to start making deposits ASAP. Be a presence. Help with homework. Volunteer to run errands. Make meals. Read stories at bedtime. Rub feet.

The golden rule of traveling parents is when you’re on the road, be working. And when you’re home, be HOME (not on your phone).

Despite the million miles and all the painful lessons I’ve learned racking them up I wouldn’t trade the experiences I’ve had traveling, and at home, for anything.

Oh, and one last thing, pick a rewards program so that you can use all of those miles flown and nights in hotels to take your family on a “free” vacation.

They love those…

Funding Independent Alternatives

A few weeks back, I was sitting at the counter of a local coffee shop waiting for my meeting to show up. As I sat, I overheard a conversation between the owner and a prospective vendor. The meeting ended with the vendor going in for the close. And their tactic struck me.

“We’re a small family owned business. We only work with a small number of customers so we can provide them the absolute highest level of service and best possible products.”

With that they shook hands and walked out.

I have no idea if they closed the deal or not. My meeting arrived and my day went on, but I couldn’t shake that pitch.

In a tech world that touts growth hacking and new features and scale, it was kind of refreshing to hear someone sell smallness and independence and a personal touch.

But, if you read the tech press you’d think that type of culture or relationship with customers wasn’t possible online. You’d think that the only way to grow and defend your business was to weaponize your balance sheet.

Pando recently wrote:

Pattern matching is in; gut feelings are out. And Facebook, Google, and Apple are just too powerful to go around.

What works now? Cash. Sh*t loads of cash. Paying to acquire users. If you are like me, you see more ads for meal kit services, startup mattress companies, upstart apparel companies, Pelotons, and the like than anything else on Facebook. That’s because those kinds of ads are one of the only way startups are growing right now.

It’s a playbook people have been terrified to return to after the dot com bust.

The result? VCs are the kingmakers again in a way they haven’t been for the last decade.

So, according to people who’s business it is to invest money the only way to truly compete is to raise more money.

Thinking face emoji.

David Packard, of Hewlett Packard, was known to share a quote from an early customer of theirs which goes something like this:

More organizations die of indigestion than starvation.

Apt in a world of software that is trying to eat everything as quickly as possible.

But, what if sh*t loads of cash wasn’t the answer?

The problems with sh*t loads of cash means you have to do sh*ts more things. Sh*t loads more hiring. Build sh*t loads more features. Enter sh*t loads more markets. Take on sh*t loads biggers leases. And take on sh*t loads more expectations and accelerated timelines of what success needs to look like.

What if there were something tech could learn from that vendor in that coffee shop?

Nearly two years ago we wrote a post suggesting that there may be an opportunity for independent businesses to outmaneuver their ravenous Unicorn competition by staying smaller, profitable and personal longer:

If you believe, as we do, that there will come a time when not having taken loads of funding, not selling out your users and not being forced to maximize shareholder value will be a competitive advantage then this type of designation might matter. Customers and users burned by cash burning startup after cash burning startup may start looking around for independent alternatives who aren’t looking to sell them out, or sell out themselves, only to have the products they love and rely on killed by acquiring companies.

Tho, that sentiment flies in the face of today’s conventional wisdom maybe, just maybe, weaponized balance sheets will backfire.

Take a look at the Techcrunch Unicorn Leaderboard (yes there is really something called a Unicorn Leaderboard).

While these mystical creatures grapple with digesting 10s, and often hundreds of millions, of investment we think there are opportunities for thoughtful, focused, slow followers building profitable independent alternatives.

If you’re one of them, get in touch.

A 12 Step Program for Breaking An Addiction to Venture Capital

Venture Capital is a hell of a drug.

At Indie.vc we’ve developed a simple 12 step program for those of you looking to break the habit in 2017:

Step 1- We admitted that we are powerless over VC’s partnership dynamics, tastes in trends, and their ever moving milestones—and that trying to time, or anticipate, them will make our lives, and the lives of our customers and employees unmanageable.

Step 2- Came to believe that a metric greater than our valuation could restore us to sanity.

Step 3- Made a decision to turn our will and our lives over to the uncompromising vision of the business we are uniquely qualified to build, not the one best suited to attract VC investment.

Step 4- Made a searching and fearless inventory of ourselves, our team and our prospects as a standalone, profitable business.

Step 5- Admitted to our team, to ourselves, and to our customers the changes needed for the viability and long term independence of our business.

Step 6- Were entirely ready to make the difficult changes to remove all unnecessary features, products and projects that were designed to tell a bigger story in hopes of attracting attention and investment from VCs.

Step 7- Humbly embrace the near term pain required to remove these distractions.

Step 8- Made a list of all the truths we’ve stretched and metrics we’ve embellished to convince VCs, and ourselves, that we were a Unicorn in embryo, and became willing to make amends to them all.

Step 9- Made direct amends to focus on creating the absolute best business we are uniquely suited to scale regardless of the potential market cap or market size.

Step 10- Continued to take inventory of our revenue, profitability and positive cash flow. When we burn more cash than we bring in, promptly admitted it and make the necessary cuts, or needed sales, to generate a profit.

Step 11- Sought through user interviews and direct interaction with customers to enhance and simplify our products and offerings to only those that improve their businesses and enrich their personal needs. Seeking only for knowledge of features and holes in our products for which customers would be willing to pay.

Step 12- Having had an awakening as the result of these steps, we tried to carry this message to unprofitable VC chasing startups, and to practice these principles in all our affairs.

Here’s to a new year filled with profitability and promise…

Meaningful Exits for Founders

For an industry that doesn’t do it for the money, we sure talk about money an awful lot in the world of startups.

A few posts were written this past week diving deeper into the numbers that drive VC returns which, in turn, drive behavior in startups who’ve raised money from VCs.

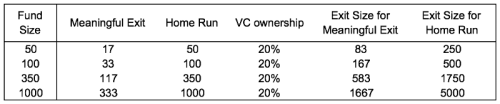

One post, written by Samuel Gil, outlined what is considered a meaningful exit for VCs. According to Sam’s math, a meaningful exit for a fund should have the ability to return 33% of a given VCs fund, a “home run” exit should be able to return their entire fund in a single investment.

This is a helpful visual he put together to show the resulting math behind meaningful exits at various fund sizes:

Across all of these scenarios, the smallest meaningful exit for the tiniest fund is a purchase price of $85M.

Now, we don’t know much in this scenario beyond the 20% owned by one fund. We don’t know how many rounds this company has raised, how many other VCs are on the cap table, nor how much the founders own.

(sidebar- most $50M funds would kill for 20% ownership these days. 5%-10% range is much more likely after the initial round of funding and dilutes rather quickly in successive rounds as reserves for pro rata vary wildly by firm).

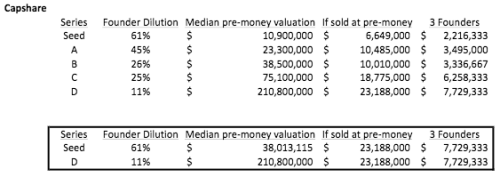

Another post from Capshare surfaced this week touching on that last bit about founder ownership at various levels of VC funding. Specifically, this post highlighted, after having analyzed over 5,000 VC backed cap tables, that founder dilution is fairly predictable based on the rounds raised by a given company. There are plenty of graphs to pour over in the post, but the summary reads as follows:

If your company exits around Series D, you can expect the following splits:

Founder ownership: 11-17%

Other employees: 17-21%

Investors: 66-68%

The data suggests startups generally have 2-3 founders so divide that number by the number of founders, and that’s the predictable founder ownership level of a Series D funded company (in the Capshare post the Series D valuation was $210M).

Reframing those numbers another way, a founder selling at the Series D price of $210M, would make the same amount of money at exit as they would have if they’d sold for $38M after having only raised a seed round.

Lifetimes of work and risk lie between a Seed round and a Series D round. And, despite increasing the value of the underlying business 7x, the dollars at exit for the founder remain roughly the same. It is also worth noting that an exit at $210M would not even qualify as a home run for even the smallest fund in Sam’s examples.

There are many paths to managing dilution- be it raising fewer rounds at higher and higher valuations, or raising one round and scaling a business on revenue and profits generated from customers.

Through our work on Indie.vc we’ve met many founders who’ve raised successive rounds of funding and had opportunities to exit their businesses for life changing sums of money; however, those acqusition offers were not meaningful exits or homeruns for their investors.

Many are looking to avoid, or at least be more aligned, with investors on the companies they are working on now. As Marc Hedlund wrote in his post about why Skyliner chose to work with us:

It should not be surprising that we chose to work with Indie.vc. It’s a choice many more entrepreneurs should make, whether you have tons of experience or are just starting out. Don’t let the normal VC business model drive your work into a low-probability, high-reward outcome, when a higher-probability outcome is well within your reach, especially one that does nothing to limit your growth.

So, let’s keep saying we don’t do it for the money.

Fine.

But, it might be worth looking more closely at the numbers before so quickly trading what’s a meaningful exit to a founder for what’s a meaningful exit to a VC.