CREATING THE FINANCIAL EXPERIENCE OF

TOMORROW

We are a financial solution provider with extensive technological and business expertise serving FIs mainly in the APAC region. Our aim is to bring value to our clients via increased efficiency, automation, and growth acceleration.

Our Solutions

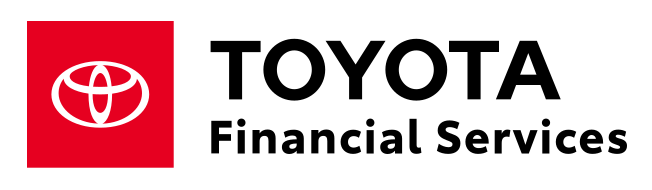

Designed with your convenience in mind, looms streamlines the borrowing process, reduces operational cost while minimizing the credit risk.

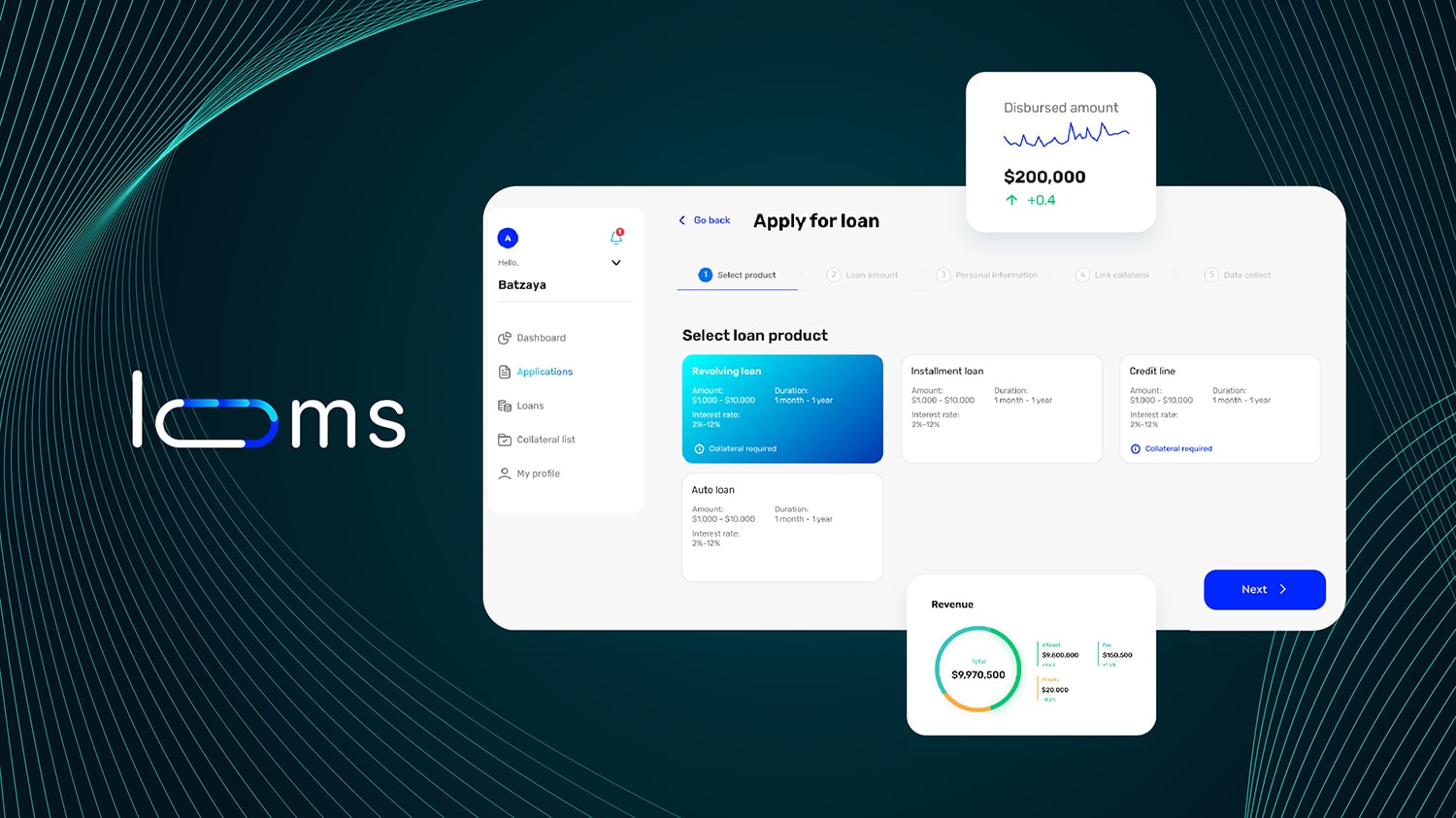

NIKO is a no-code automated machine learning platform designed to make AI accessible for business decision-making. Accelerate your business growth through data-driven decision-making with NIKO’s end to end features.

Designed with your convenience in mind, looms streamlines the borrowing process, reduces operational cost while minimizing the credit risk.

CLiENTS AROUND THE WORLD

12 Countries

20+ International Deals

Lending system for a commercial bank (Cambodia)

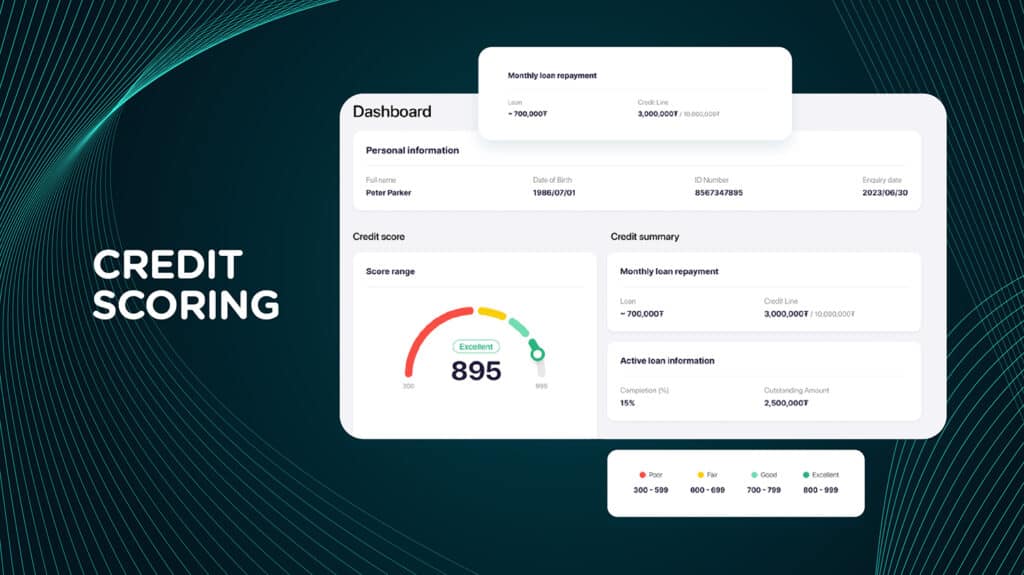

Credit scoring and lending system for a leading NBFI (Mongolia)

Lending and credit scoring system for the leading micro-lending fintech service provider covering over half the adult population of Mongolia

India, SME credit scoring service (In collaboration with SCV)

Enterprise scoring system for micro, small and medium enterprises in collaboration with the Standard Chartered Ventures.

Client success story #1

3.8M

Client success story #2

600K

Latest & Recent

Blogs, News, and Updates

How AI can revolutionize banking and boost financial inclusion.

Just a few years ago, generative AI was a mere buzzword. Then came ChatGPT in 2022, and suddenly, this novel concept became an undeniable force reshaping our world. This AI

Reimagining Financial Inclusion in Southeast Asia: Challenges and Solutions

Southeast Asia’s fintech landscape is brimming with potential, but a large portion of the population remains excluded from essential financial services. Limited access to formal banking, heavy reliance on cash

mindox team attended Digital Banking Asia Summit 2024

The Philippines’s premier Digital Banking Asia Summit 2024, concluded on a high note on March 13th, 2024. Among the leading innovators showcasing their solutions was mindox, the AI-powered document processing

Say Goodbye to Manual Entry: Introducing mindox, Our Intelligent Document Processing Solution

In today’s fast-paced business environment, efficiency is key. Yet, many organizations still find themselves bogged down by manual data entry processes, consuming valuable time and resources. Enter mindox, our revolutionary

Future-Proof Your Business: The Indispensable Role of Technological Solutions in 2024

Introduction: As 2024 unfolds, the business world finds itself at a pivotal juncture, heavily influenced by rapid technological advancements. In this era, digital transformation is no longer a choice but

Elevating Loan Origination and Management in 2024

Introduction: In 2024, the financial landscape continues to shift dramatically, making loan origination and management systems increasingly vital. These aren’t just tools; they represent a significant leap forward in how